The Way Forward on Security

Everything that is wrong with America’s economic security system can be fixed.

Nine policy changes are needed. If we adopt them, we can cut unemployment and poverty by well over 50%.

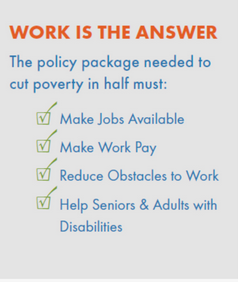

The starting point is work. The economic security system should primarily be work-based. It should make work available. It should make work pay. It should reduce obstacles to work.

Work First

The following six work-based policy changes are the key:

(1) Transitional Jobs

The answer to unemployment is to create a flexible program of Transitional Jobs (TJs) for workers who face difficulty in finding regular employment.

TJs would offer unemployed and underemployed adults the opportunity to do useful work at the minimum wage...which, as discussed below, would be higher for all workers. TJs would be easily available in both the non-profit and for-profit sectors. TJ workers would be required to seek regular, unsubsidized employment.

Individuals who work in a TJ (assuming 40 hours of work, for 50 weeks a year) would earn--at the minimum wage of $10 per hour (as proposed below)--a total of $20,000. Their earnings would leverage a larger Earned income Tax Credit than today (as proposed below), thus yielding an earnings-based income well above the poverty line. Nonetheless, since TJs would not pay above the minimum wage, the incentive would be strong to pursue and take a regular, unsubsidized job, which almost always would pay more and offer the opportunity for wage growth.

Federal legislation to create a national Transitional Jobs program has been introduced by U.S. Senators Tammy Baldwin and Cory Booker. Read More -> It has already won the endorsement of the National Urban League. Read More ->

Designing and and operating a successful TJ program is challenging. The key to success is to structure the TJs so that they resemble, as much as possible, jobs in the regular labor market. Read More ->

(2) Higher Minimum Wage

To assure workers a decent income, the first step is to raise the minimum wage. The federal minimum wage has been stuck at $7.25 per hour for years. Several cities and states have already raised it to as high as $15.00 per hour Many U.S. workers, however, continue to be paid $7.25 per hour or only a little more.

To guarantee a decent "foundation" income for all workers, the federal minimum wage should be increased to at least $10 per hour, rise quickly to $12 per hour, and be indexed for inflation. According to most economists, the trade-offs in raising the wage to $10 per hour (i.e., job loss vs. income gain) are modest. Read More -> According to the Congressional Budget Office (CBO), while such an increase would result in a small degree of job loss (or job non-creation), the benefits--in terms of both higher income and the stimulation of new job creation--would be far greater. Read More ->

(3) Reformed Earning Supplement

Even a higher minimum wage will not be enough to allow many workers to support themselves and their families. To assure all full-time workers a decent income, it is necessary to improve—and reform—the nation’s existing system of earning supplements: the Earned Income Tax Credit (EITC) plus the Child Tax Credit (CTC).

The EITC and CTC should be combined into a single, simpler, better Earnings Supplement. It should provide a much larger refundable tax credit for “childless” adults, as well as bigger credits for workers with dependent children. The new Earnings Supplement should also be structured to reduce--and eventually eliminate--the current “penalties” for additional work (i.e., heavy loss of the supplement as earnings rise above $18,000 per year) and marriage (i.e., two low income workers may get more EITC by not marrying).

The new Earnings Supplement formula should guarantee that full-time workers always bring home an earnings-based income--i.e., the sum of their paycheck plus the supplement--that lifts them well above the poverty line. A variety of options exist to accomplish this goal, including one that the Community Advocates Public Policy Institute designed. Read More ->

(4) Collective Bargaining

Membership in labor unions has declined sharply over the last several decades. There is strong reason to believe that the drop in union membership has impeded the U.S. inability since the 1970s to reduce poverty further, raise most families' incomes, and achieve higher rates of health insurance coverage. Strengthening collective bargaining is an essential component in the effort to improve economic security.

When a majority of employees requests an election to decide if they will have a union, the election should be held immediately and without intimidation by the employer. In addition, unions everywhere in the U.S. should be free to negotiate a contract that requires all covered employees to contribute to the contract’s negotiation and enforcement.

(5) Affordable Childcare

All job-seeking and working parents should have access to affordable childcare for their younger children (at least through age 12). Read More ->

(6) Paid Leave

Finally, all civilian workers should be guaranteed paid family leave. They should be able to take time off from work to care for a newborn child, welcome an adopted child to a new home, or care for an ailing parent without giving up their entire income. Read More ->

For Those Outside the Labor Market

Poverty is also a serious problem for many Americans outside the labor market. They may be unable to work because of a serious disability, yet receive inadequate disability benefits. Or they may have retired at 65 or older on Social Security, but get too small a payment to live in comfort. The solution is simple: boost their income.

(7) Disability Benefit Reform

Adults who cannot work, due to a severe disability that justifies the receipt of disability benefits, should always get disability benefits that lift them out of poverty. At the same time, they should have clear incentives to work, and no penalty for marriage.

To achieve these goals, the two major U.S. disability benefits programs--Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI)--should be combined into a larger version of SSDI. The minimum payment should be set well above the poverty line. Recipients should be able voluntarily to convert their benefits into wages earned in a Transitional Job (with the right to revert at any time). Health insurance should be guaranteed at all times. Read More ->

(8) Social Security Reform

Of equal importance, seniors who have reached 65 or more and retired on Social Security should also always receive a minimum Social Security payment that gets them well above the poverty line. Read More ->

(9) Automatic Retirement Savings

In addition, seniors would benefit from an automatic retirement savings program that allows them (unless they opt out) to build up additional resources for retirement. Australia has a mandatory program; that may be too much for Americans to swallow. But several U.S. states are implementing a voluntary program, which could be extended to other jurisdictions or adopted on a national basis. Read More ->

The Evidence: Dramatic Reductions in Unemployment and Poverty

There is a growing body of evidence that this seven-part policy package will dramatically reduce the level of American unemployment and poverty.

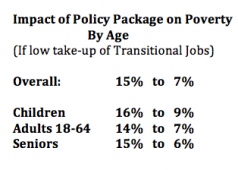

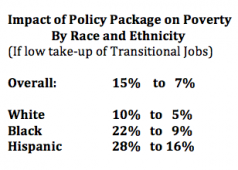

Analyses of different variants of the policy package for Wisconsin, New York City, and U.S. Children, which the independent Urban Institute conducted using its TRIM3 microsimulation model, showed cuts in the poverty rate of 50% or more. The Urban Institute measured the policies' poverty-reducing impact by applying the Supplemental Poverty Measure, (SPM) which (compared to the "official" poverty measure) takes into account both cash and non-cash resources and applies realistic poverty "thresholds" that reflect regional differences in housing costs.

Most recently, in 2015, an Urban Institute analysis of one version of the policy package designed by the Community Advocates Public Policy Institute estimated that, if in effect in 2010, it would have reduced the U.S. poverty rate by:

- 50%, assuming a quarter of the unemployed poor go to work in a Transitional Job;

- 58%, assuming half of the unemployed poor go to work in a Transitional Job.

We now know how to drive down unemployment and poverty to a residual level.

There is no other evidence that any other policy, or combination of policies, will succeed.

The question that remains is: Will American policymakers embrace what works, and enact the laws necessary to drive down the poverty rate to low single digits ?