Running the Numbers

The ultimate test of any new design for American government must be: Do the numbers work? Does the budget add up? The answer, here, is: Yes.

Government budgets do not fall from outer space. People create them. Budgets are compilations of thousands of detailed choices about how much to spend, where to spend, and how to raise revenue. Assumptions, priorities, and specific policies that elected officials agree on drive budgets at every level. Changes in these assumptions, priorities, and policies in turn reshape budgets from year to year.

The many policy changes proposed here for redesigning American government--involving the creation of new programs, the elimination of existing ones, and the reform of user fees and taxes-- will result in dramatic changes in government budgets at every level. The biggest fiscal impacts will occur within government budgets, not in the overall fiscal picture. Despite the dramatic nature of the proposed reforms, there will be no dramatic change in total government spending or revenue.

From Policy to Budget

Policy change is the driver of budget change. So it is useful here to summarize the major policy reforms that will most profoundly alter local, state, and federal budgets.

- The top sidebar highlights the proposed policy changes that will have the biggest impacts on governments' budgets.

- The middle sidebar notes two major policy changes that will occur "off-budget," although both will indirectly influence government budgets at all levels.

- The final sidebar summarizes the resulting shifts in responsibility that will occur among the three levels of government.

The Bottom Line

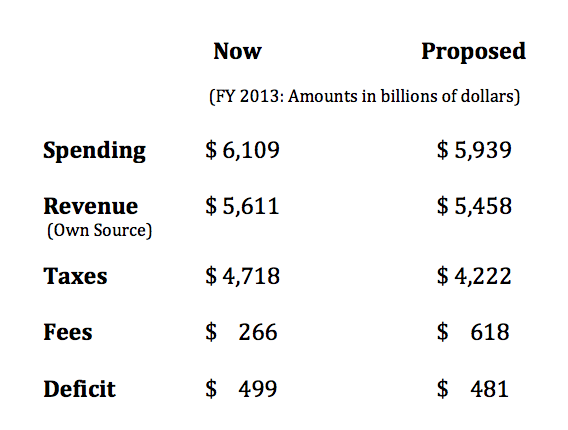

The bottom line for American government as a whole, if all of the reforms proposed here had taken effect in FY 2013, would be as follows:

- Spending: Spending would have fallen, from $6,109 billion to $5,939 billion;

- Revenue: Own-source total revenue (i.e., not provided by another level of government) would also have declined, from $5,611 billion to $5,458 billion;

- Taxes: Taxes would have fallen substantially, from $4,718 billion to $4,222 billion;

- Fees: Utility fees would have risen substantially, from $266 billion to $618 billion;

- Deficit: The combined deficit would have shrunk a bit, from $499 billion to $481 billion.

The following table highlights these "headline" results:

But what about the details?

Precision has been one of the themes of this proposed redesign of government. What exactly should government do? How, exactly, should it raise the dollars it needs? How, exactly, should it deliver services? The strength of a public policy depends in large part on whether it can be made operational in all of its detail.

The following link thus provides detailed estimates of how spending and taxes would change, at all levels of government, if the proposed redesign of government were operational. It illustrates exactly what governmental budgets would have looked like in a recent year--Fiscal Year (FY) 2013--if the major policy changes proposed here were in full effect. It shows how different local budgets, state budgets, and the federal budget would look.

Because the details are too lengthy to present on this page, please: Read More ->

Overall

Viewed as a whole--that is, when local, state, and the federal budget are added together--the most notable feature of the proposed re-design of American government is that it would not result in dramatic changes in overall spending or revenue.

Budgeted spending would decline...somewhat. Budgeted revenue would fall...somewhat. A significant decrease in taxes would be offset by a similar rise in utility fees. The deficit would shrink, if modestly, thus advancing the date when government budgets come into balance.

As Sherlock Holmes pointed out in his famous remark about the dog that did not bark in the night, the most striking conclusion about the budget revisions proposed here as part of putting American government in its place is that they do not dramatically alter the overall fiscal picture of American government.

The Inside Story

Rather, it is within each level of government that the most dramatic budgetary changes would occur. The final sidebar on the left highlights this sorting out.

The underlying logic of the sorting out is to assign responsibility for each major governmental function to a single level of government that either (1) is now already most responsible for the function, or (2) uses taxes that most directly relate to the function and can best handle the function's cost.

The most important consequence of the sorting out, however, is to improve government's accountability. When everyone is in charge (as is the case today with governmental responsibility for K12 education, health insurance, and other tasks), no-one is in charge. Thus, no particular government is responsible when current policy on K12 education, health insurance, etc., underperforms so badly.

When a single level of government is assigned responsibility for a particular function of government, however, accountability should greatly improve. We all know who's in charge; we can hold the government in question accountable.